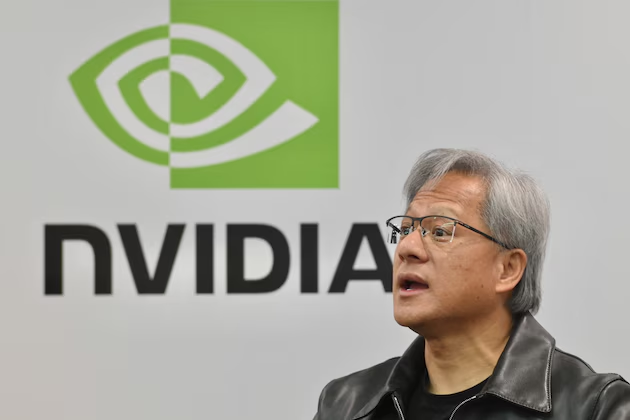

Buy Nvidia’s stock on the dip, these analysts say

Nvidia’s stock is down on Thursday.

In recent months, Nvidia’s stock has experienced a dip, prompting concern among some investors. However, according to a growing number of market analysts, this temporary downturn represents a prime buying opportunity. Here’s why experts believe Nvidia’s current dip is an attractive entry point for long-term investors.

Nvidia’s Market Position

Nvidia has long been a dominant player in the semiconductor industry, known for its cutting-edge graphics processing units (GPUs). These GPUs are essential not only for gaming but also for an array of high-growth sectors, including artificial intelligence (AI), data centers, autonomous vehicles, and cryptocurrency mining. Nvidia’s innovation and leadership in these areas have solidified its reputation as a critical enabler of the digital age.

Recent Market Dynamics

The recent dip in Nvidia’s stock can be attributed to a mix of macroeconomic factors, including concerns about interest rate hikes, potential slowdowns in the tech sector, and geopolitical tensions affecting global supply chains. Additionally, some investors may be taking profits after Nvidia’s extraordinary rally earlier in the year. Despite these short-term headwinds, analysts believe the underlying fundamentals of Nvidia remain robust.

Analysts’ Optimism: Growth Drivers

- AI and Data Centers: Analysts are particularly bullish on Nvidia’s prospects in AI and data centers. The company’s GPUs are the backbone of AI development, powering everything from machine learning algorithms to complex data analytics. As demand for AI technology continues to surge across industries, Nvidia is well-positioned to benefit from this trend.

- Gaming Industry Resilience: The gaming sector remains a significant revenue driver for Nvidia. While the gaming industry has seen some fluctuations, the long-term outlook remains positive, especially with the rise of cloud gaming and the metaverse. Nvidia’s GPUs are crucial for delivering the high-quality graphics required by these new technologies.

- Autonomous Vehicles: Nvidia’s advancements in AI also extend to the automotive sector. The company’s Drive platform is a leader in the autonomous vehicle industry, offering a suite of hardware and software solutions that are critical for the development of self-driving cars. As this industry matures, Nvidia stands to gain considerably.

- Cryptocurrency Volatility: While the cryptocurrency market has been volatile, it has also driven demand for Nvidia’s GPUs, which are used in mining operations. Although this demand can be unpredictable, it provides an additional revenue stream that can boost Nvidia’s financial performance during crypto booms.

Financial Health and Valuation

Despite the dip, Nvidia’s financial health remains strong. The company continues to generate substantial revenue and profit, supported by its diverse product portfolio. Analysts argue that the recent decline in stock price has brought Nvidia’s valuation to more attractive levels, making it a compelling buy for long-term investors.

The Consensus

Several prominent analysts have issued buy ratings on Nvidia, with price targets significantly above current levels. They argue that the dip is a short-term fluctuation and does not reflect the company’s long-term potential. As such, they recommend taking advantage of the lower prices to build or add to positions in Nvidia.

Risks to Consider

While the outlook for Nvidia is positive, investors should be aware of the potential risks. The semiconductor industry is highly competitive, and Nvidia faces challenges from other tech giants like AMD and Intel. Additionally, macroeconomic uncertainties, such as inflation and supply chain disruptions, could impact the company’s performance in the near term.

Conclusion

Nvidia’s recent stock dip offers a strategic opportunity for investors who believe in the long-term potential of the company. With its leadership in AI, gaming, and autonomous vehicles, Nvidia is poised for continued growth. Analysts recommend buying on the dip, with the expectation that the stock will recover and reach new heights as the company capitalizes on its strong market position.

Investors should carefully consider their risk tolerance and investment horizon, but for those with a long-term perspective, Nvidia’s dip could be a golden opportunity to invest in one of the tech industry’s most promising companies.